Unlock Your Brand's Potential: Why Awareness Matters

Understanding how well your target audience knows your brand is crucial for growth. But how do you quantify this awareness? Effectively measuring brand awareness allows you to gauge marketing effectiveness, track competitor positioning, and understand the return on your brand-building investments. This article outlines 8 powerful methods to accurately measure brand awareness. Discover techniques ranging from recall surveys and social media analysis to search volume trends and advanced research methods. Gain the actionable insights needed to make smarter marketing decisions and strengthen your market presence.

1. Aided Brand Recall Surveys

Aided brand recall surveys represent a fundamental and widely used technique to measure brand awareness. This method specifically gauges brand recognition, which is the consumer's ability to confirm prior exposure to a brand when prompted. In essence, you present respondents with a list of brand names (often including your brand, key competitors, and sometimes decoys) and ask them to identify the ones they have heard of before. Because it directly asks about recognition from a provided list, it's often considered a foundational layer in understanding how familiar your brand is within its target market, making it a crucial first step in many brand tracking initiatives.

How Aided Recall Works and Its Key Features

The methodology is straightforward yet effective. Typically administered through online platforms, phone interviews, or even in-person intercepts, these surveys present a list of brands within a specific category.

- Structured Format: Questions are usually multiple-choice ("Which of the following [product category] brands have you heard of? Please select all that apply.").

- Brand Lists: The core feature is the list itself, which includes the target brand(s), relevant competitors, and potentially fictional or irrelevant "decoy" brands. Decoys help gauge the level of guessing or inattention among respondents.

- Measurement Focus: It directly measures recognition – a passive level of awareness – rather than spontaneous (unaided) recall, where respondents must retrieve brands from memory without prompts.

- Administration Flexibility: Surveys can be deployed across various channels, allowing for broad reach or targeted sampling depending on the research goals.

Why and When to Use Aided Brand Recall

This approach is particularly valuable for several scenarios relevant to Fortune 100 companies, tech startups, and corporate marketing teams alike:

- Establishing Baseline Awareness: For new brands (like tech startups entering the market) or products, aided recall provides a clear benchmark of initial recognition levels.

- Tracking Recognition Over Time: Corporate marketing teams can use consistent aided recall questions in periodic surveys to monitor how marketing campaigns, events, or PR efforts impact brand visibility relative to competitors.

- Competitive Benchmarking: It allows for a direct comparison of recognition levels against specific competitors included in the list, identifying which brands have greater salience in the consumer's mind when prompted.

- Resource Efficiency: Aided recall surveys are generally less cognitively demanding for respondents than unaided recall (where they have to think harder), often leading to higher completion rates and being easier to administer and analyze quickly. Venture Capital firms might look at this data as an early indicator of market traction for portfolio companies.

Pros and Cons of Aided Recall

Pros:

- Ease of Administration: Relatively simple to design, deploy, and analyze.

- Quantifiable Data: Yields clear percentages for brand recognition.

- Lower Respondent Burden: Less demanding than unaided recall, improving participation.

- Direct Competitor Comparison: Allows simultaneous measurement of awareness for multiple brands.

- High Completion Rates: The simpler task typically results in fewer drop-offs.

Cons:

- Potential Overestimation: Seeing the brand name can inflate recognition scores due to guessing or false familiarity.

- Limited Depth: Doesn't reveal the strength of memory, brand associations, or likelihood of consideration (top-of-mind awareness).

- Order Bias: Recognition can be influenced by the order in which brands appear if the list isn't randomized.

- Less Insightful than Unaided Recall: Doesn't measure if a brand is spontaneously recalled, which is often a stronger indicator of brand strength.

- Social Desirability: Respondents might claim recognition to appear knowledgeable.

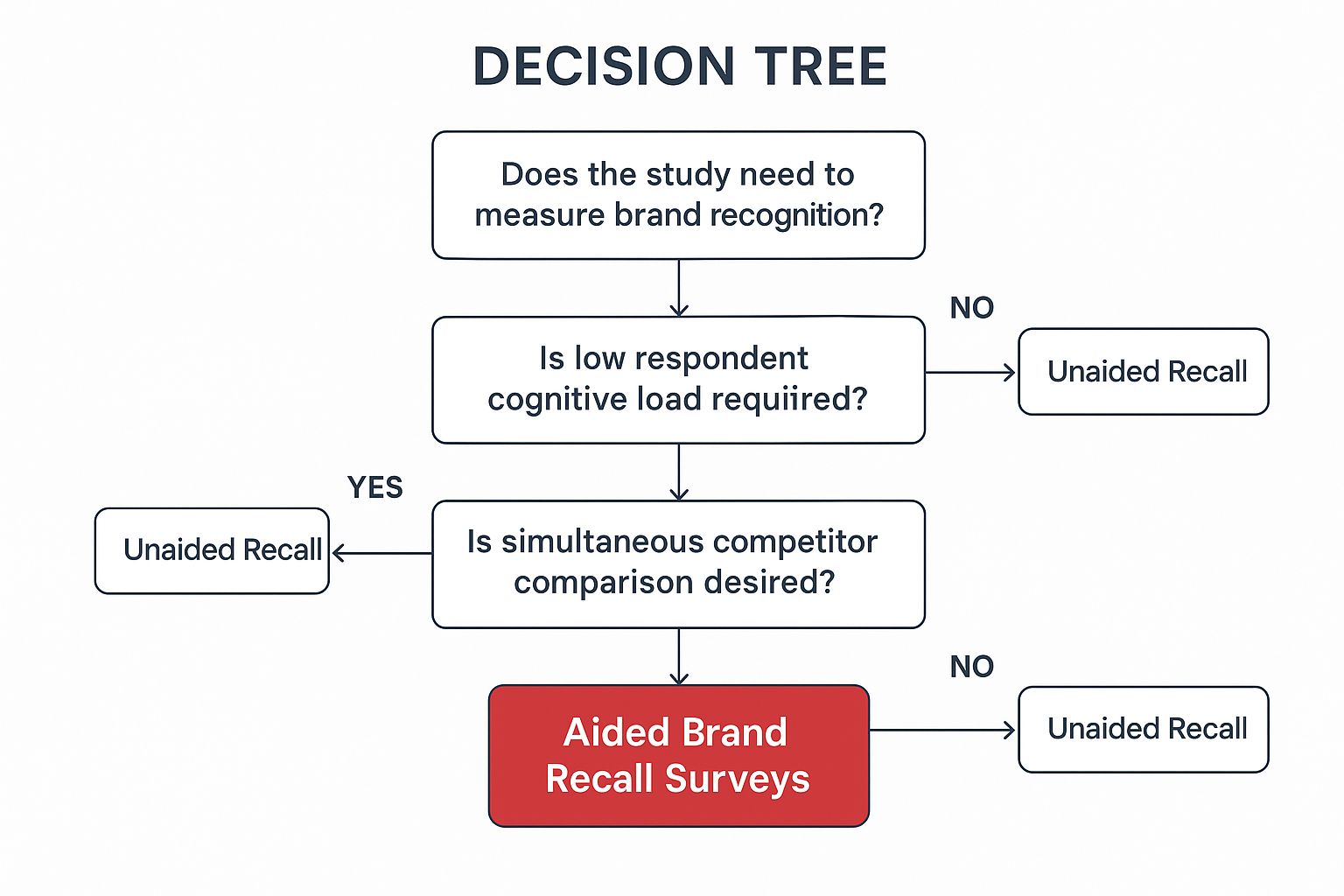

Making the Right Choice: Using the Decision Tree

Deciding which method to use to measure brand awareness can be complex. Aided recall is powerful for recognition, but is it the right fit for your specific goal, resources, and the depth of insight required? This decision tree infographic guides you through key questions to determine if Aided Brand Recall Surveys are the optimal approach for your current needs, or if other methods might be more suitable.

The following infographic visualizes this decision process:

As the flowchart illustrates, key decision points include whether your primary goal is to measure basic recognition versus spontaneous recall, if directly comparing recognition levels against a specific list of competitors is crucial, and considerations around survey complexity and desired respondent engagement. Following the paths helps determine if aided recall alone, perhaps combined with other methods like unaided recall, or an alternative approach entirely, best suits your objective to effectively measure brand awareness.

Actionable Tips for Implementation

To maximize the value and accuracy of your aided brand recall surveys:

- Randomize Brand Order: Always shuffle the order of brands presented to each respondent to mitigate order bias.

- Include Decoys: Use plausible but fictional brand names within the list to identify respondents who are guessing or not paying attention.

- Ensure Consistency: For tracking studies, keep the methodology, brand list (where appropriate), and survey administration consistent over time.

- Segment Your Results: Analyze recognition levels across different demographic, psychographic, or behavioral segments (e.g., age groups, customer vs. non-customer) to uncover awareness gaps or target audience strengths.

- Combine with Unaided Recall: For a more comprehensive understanding, pair aided recall questions with unaided recall questions (e.g., "What brands of [product category] come to mind first?") in the same survey.

Examples and Provenance

Aided recall is a staple in market research. Think of Coca-Cola using it to track awareness of a new Diet Coke flavor variant against competitors like Diet Pepsi. Research giants like Nielsen and Ipsos routinely employ aided recall in their syndicated Brand Awareness studies across numerous consumer categories. Even political campaigns use aided recall to measure basic name recognition for their candidate compared to opponents. The methodology's prominence in brand equity measurement was significantly influenced by researchers and authors like David Aaker.

For those looking to implement robust brand tracking studies incorporating methods like these, further insights can be beneficial. Learn more about Aided Brand Recall Surveys and how they fit into a broader measurement strategy.

2. Unaided Brand Recall Surveys

What It Is and How It Works:

Unaided brand recall, often referred to as spontaneous awareness, is a fundamental technique used to measure brand awareness by assessing how readily a brand comes to a consumer's mind without any external prompts or clues. Unlike aided recall methods where respondents are shown a list or given hints, unaided recall relies purely on memory retrieval.

The methodology is straightforward yet powerful: respondents are typically asked an open-ended question related to a specific product or service category. A classic example would be, "When you think about [product category, e.g., electric vehicles], which brands come to mind?" The interviewer or survey system then records all the brands the respondent names, often noting the order in which they are mentioned. The first brand mentioned is particularly significant, indicating "top-of-mind awareness" (TOMA).

Why It Deserves Its Place:

Unaided recall earns its crucial spot high on any list about how to measure brand awareness because it represents a much stronger and more valuable form of awareness than simple recognition. If a consumer can spontaneously name your brand when thinking about a category, it signifies that your brand occupies a meaningful position in their mental landscape for that category. This "mental availability" is a strong precursor to being included in a consumer's consideration set when they are actively looking to make a purchase. It reflects deeper brand salience and is often correlated with market share and brand strength.

Key Features:

- Open-Ended Questioning: Relies entirely on the respondent's ability to generate brand names from memory, without any lists or prompts.

- Category-Specific Focus: Questions are framed around a clearly defined product or service category (e.g., "streaming services," "athletic footwear," "cloud computing providers").

- First-Mention Tracking (TOMA): Captures the very first brand named, considered the highest level of recall and a key indicator of market leadership or strong mental positioning.

- Depth of Awareness Measurement: The total number of brands a respondent can recall within the category provides insight into their category knowledge and the competitive landscape they perceive.

- Follow-Up Probes (Optional): Sometimes includes questions about the brands mentioned, such as familiarity, usage, or perception, particularly regarding the first-mentioned brand.

Benefits (Pros):

- Measures Stronger Awareness: Accesses deeply embedded brand knowledge, indicating genuine salience rather than just passive recognition.

- Better Predictor of Behavior: Brands recalled unaided are more likely to be considered during purchase decisions compared to those only recognized when prompted.

- Reveals True Mental Position: Provides an uninfluenced view of where a brand stands in the consumer's mind relative to competitors.

- Identifies Market Leaders: First-mention analysis clearly highlights the dominant brands within a category from the consumer's perspective.

- Not Susceptible to Recognition Bias: Avoids artificially inflating awareness scores simply because a respondent recognizes a name shown to them.

Challenges (Cons):

- Administration & Analysis Complexity: More difficult and time-consuming than aided methods, especially coding and categorizing diverse open-ended responses accurately.

- Coding Requirement: Open-ended answers necessitate a robust coding process to handle misspellings, variations (e.g., "Coke" vs. "Coca-Cola"), and irrelevant mentions.

- Higher Cognitive Load: Requires more effort from respondents, potentially leading to lower completion rates or shorter lists of recalled brands compared to their actual knowledge.

- May Underestimate Recognition: Does not capture brands that a consumer would recognize if prompted, potentially understating the total reach of brand messaging.

- Interviewer Dependence (Qualitative Settings): In face-to-face or phone interviews, the interviewer's skill in probing without leading can impact response quality.

When and Why to Use This Approach:

Unaided brand recall surveys are particularly valuable when you need to:

- Assess Top-of-Mind Awareness (TOMA): Determine if your brand is the first one consumers think of in your category.

- Benchmark Against Competitors: Understand your brand's spontaneous recall relative to key competitors.

- Evaluate Marketing Campaign Effectiveness: Measure changes in unaided recall before and after significant advertising or branding initiatives to gauge impact on salience.

- Understand the Consumer Consideration Set: Identify the pool of brands consumers naturally consider when making decisions in your market.

- Track Brand Health Over Time: Monitor trends in spontaneous awareness as a key performance indicator for brand building efforts.

This method is essential for Fortune 100 companies managing established portfolios, Tech Startups aiming to break into crowded markets and establish mindshare, Corporate Marketing Teams tracking ROI on brand spend, and Venture Capital Firms assessing the brand traction of potential investments.

Examples of Successful Implementation:

- Interbrand's Best Global Brands: Annual reports often incorporate awareness metrics, where unaided recall is a key input for assessing brand strength and value.

- Pepsi Challenge Campaigns: Historically, Pepsi used recall studies (often implicitly or explicitly tracking unaided recall) to measure shifts in consumer perception and top-of-mind awareness versus Coca-Cola following campaigns.

- Apple in Smartphones: Tech giants like Apple continuously monitor brand health metrics, including unaided recall and first-mention awareness within the smartphone category, to maintain their market-leading position.

Actionable Tips for Implementation:

- Develop a Rigorous Coding Scheme: Before fieldwork, create clear guidelines for categorizing open-ended responses, accounting for abbreviations, misspellings, and brand variations. Ensure consistency across coders.

- Define Categories Clearly and Consistently: Ensure respondents and analysts share the same understanding of the product/service category boundaries. Use the exact same definition for longitudinal tracking.

- Track Both First Mention and Total Mentions: Analyze TOMA separately from the overall number of times your brand is mentioned spontaneously.

- Allow Sufficient Response Time: Don't rush respondents. Give them adequate time to think and recall as many brands as they can to get a fuller picture.

- Pilot Test Your Questions: Ensure the category definition is understood and the open-ended question elicits relevant responses before launching a large-scale survey.

In summary, unaided brand recall surveys provide a critical and robust way to measure brand awareness, offering deep insights into a brand's true strength and position within the competitive landscape and the consumer's mind. While more demanding than aided methods, the insights gained are invaluable for strategic brand management.

3. Brand Recognition Testing

Brand Recognition Testing is a crucial method used to measure brand awareness by evaluating how well consumers can identify a brand solely through its non-name elements. Unlike brand recall, which asks consumers to name brands within a category, recognition focuses on identifying specific visual or auditory cues like logos, color palettes, packaging shapes, jingles, or sonic identities when the brand name itself is hidden or removed. It directly assesses the strength and penetration of a brand's sensory identity markers in the minds of the target audience.

This methodology digs into the visual and auditory memory associations consumers have formed with a brand. It's particularly valuable for understanding the effectiveness of investments in brand identity design and sensory branding initiatives. By isolating specific elements, companies can pinpoint which assets are most strongly associated with their brand and which may need refinement.

How Brand Recognition Testing Works:

The core process involves presenting respondents with specific brand assets, often modified or shown partially, and asking them to identify the associated brand. Key features include:

- Visual Asset Testing: Commonly tests logos (sometimes de-branded or partial), unique color combinations, distinctive packaging silhouettes, character designs, or even specific typography styles.

- Auditory Element Testing: Can incorporate jingles, brand anthems, sonic logos (short distinct sounds like Intel's or Netflix's), or characteristic sound designs used in advertising.

- Modified Stimuli: Often uses elements with the brand name removed or obscured to purely test the power of the visual or auditory cue itself. Partial or slightly altered elements can test the robustness of recognition.

- Administration Methods: Can range from simple online surveys displaying images or playing sounds to more controlled in-person interviews.

- Advanced Measurement: Sophisticated applications might involve eye-tracking technology to see where attention focuses on packaging or ads, or measure response times to gauge the automaticity and strength of the association (faster response often indicates stronger recognition).

Why Brand Recognition Testing is Essential:

This method earns its place in any comprehensive strategy to measure brand awareness because it directly evaluates the performance of tangible brand assets. While recall measures unaided memory, recognition measures aided memory triggered by specific cues, reflecting how consumers might react when encountering the brand's identity in the real world (e.g., on a shelf, in a fast-scrolling feed).

Benefits (Pros):

- Measures ROI of Identity: Directly assesses the effectiveness of investments in logo design, packaging, sonic branding, etc.

- Identifies Strengths/Weaknesses: Reveals which brand elements are highly recognizable and which are failing to connect.

- Lower Bias: Less susceptible to the self-reporting biases that can affect recall questions ("I think I know that brand..."). Recognition is often more definitive.

- Pre-Launch Testing: Allows brands to test consumer recognition of new or redesigned logos, packaging, or sounds before a costly full market launch.

- Optimization Guidance: Provides clear, quantitative insights to guide decisions on refining or amplifying specific brand identity elements.

Limitations (Cons):

- Requires Stimuli: Needs visual or auditory materials, making purely text-based or simple phone surveys unsuitable.

- Recognition vs. Recall: High recognition doesn't automatically mean consumers can recall the brand name when prompted by the category need.

- Artificial Environment: The testing context might not perfectly replicate real-world exposure scenarios (e.g., cluttered shelves, noisy environments).

- Complexity: Can be more complex and resource-intensive to design and administer than standard awareness surveys, especially with advanced techniques.

- Equipment Needs: Eye-tracking or precise response time measurement requires specialized software and potentially hardware.

Examples of Successful Implementation:

- McDonald's: Routinely tests the recognition of the Golden Arches globally, often shown without the company name, to ensure this core visual asset remains powerfully linked to the brand across diverse markets.

- Mastercard: Conducted extensive recognition studies in 2019 when removing the "Mastercard" name from its logo, relying solely on the interlocking red and yellow circles. Testing confirmed high recognition levels, validating the strategic move.

- Nike: The "Swoosh" is one of the most recognized logos globally. Nike continuously monitors its recognition, ensuring its power translates across different product categories, demographics, and international markets, often testing it in isolation.

When and Why to Use Brand Recognition Testing:

Employ this method when:

- You need to measure brand awareness tied specifically to your visual or auditory identity.

- Evaluating the impact of a rebrand or refresh of specific identity elements.

- Understanding if key brand assets (logo, colors, jingle) are distinct and memorable compared to competitors.

- Making investment decisions about which brand identity elements to prioritize or strengthen.

- Assessing brand health in new markets or demographics.

Actionable Tips for Effective Testing:

- Vary Exposure Duration: Test recognition at different speeds (e.g., brief flash vs. longer exposure) to gauge the strength and automaticity of the association.

- Include Controls: Mix in competitor logos/elements and neutral "control" stimuli to benchmark performance and ensure respondents aren't just guessing.

- Segment Your Audience: Analyze recognition levels across different demographics, customer segments, and geographic markets to identify variations.

- Compare Elements: Test recognition of different assets (logo vs. color palette vs. slogan visual) to understand their relative contribution to overall brand identity.

- Measure Speed and Accuracy: Don't just track if they recognize it, but how quickly and accurately. Faster, accurate responses indicate stronger mental links.

Influential Proponents:

The importance of recognizable brand assets is a key theme in the work of Byron Sharp (author of 'How Brands Grow'), who emphasizes building mental availability through distinctive assets. Brand consultancies like Landor Associates frequently use recognition testing in their identity work. Foundational research by figures like Reeves and Roose in advertising also touched upon the power of visual recognition.

Watch: Understanding Brand Recognition

In summary, Brand Recognition Testing is a powerful, focused technique to measure brand awareness by assessing the direct link between a brand's sensory assets and consumer memory. It provides invaluable, actionable data for Fortune 100 companies managing global identities, tech startups building recognition from scratch, corporate marketing teams optimizing campaigns, and VCs assessing brand strength in potential investments.

4. Social Media Listening and Mention Analysis

Social media listening offers a powerful, real-time lens to measure brand awareness by tapping into the vast, unprompted conversations happening online. It involves utilizing specialized tools to systematically monitor mentions of your brand name, products, key personnel, campaigns, and relevant industry keywords across a wide array of digital platforms. This includes not just major social networks (like Twitter, Facebook, Instagram, LinkedIn, TikTok), but also extends to forums (like Reddit), blogs, news sites, review platforms, and other online communities where people share opinions and experiences. The core idea is to capture organic awareness – understanding how often and in what context your brand surfaces in natural, everyday digital interactions.

This methodology rightfully earns its place in any comprehensive strategy to measure brand awareness because it provides insights that surveys or direct traffic analysis often miss. It captures spontaneous awareness and perception, reflecting what people really think and say when they aren't directly prompted by a researcher. For Fortune 100 companies managing global reputations, tech startups aiming to track viral buzz, or corporate marketing teams evaluating campaign resonance, this approach offers an invaluable, continuous pulse on market presence.

How it Works & Key Features:

Social listening platforms (such as those developed by Brandwatch, Sprout Social, and Talkwalker) employ sophisticated crawlers and APIs to gather mentions. The real power lies in their analytical capabilities, often leveraging Natural Language Processing (NLP) and machine learning:

- Multi-Platform Monitoring: Scans diverse online sources for mentions.

- Volume Analysis: Tracks the sheer number of mentions over time, indicating the level of discussion surrounding the brand.

- Sentiment Analysis: Automatically categorizes mentions as positive, negative, or neutral, providing a gauge of overall brand perception.

- Contextual Analysis: Goes beyond simple keyword spotting to understand the meaning behind the mentions – are people praising a feature, complaining about customer service, or comparing you to a competitor?

- Share of Voice (SoV): Measures your brand's mention volume relative to key competitors, providing a critical benchmark for market presence.

- Real-Time Data: Unlike periodic surveys, social listening provides continuous data flow, allowing for immediate insights and rapid response.

Successful Implementation Examples:

- Airbnb: Can utilize social listening to monitor mention spikes and sentiment shifts during major marketing campaigns or following significant policy changes, gauging real-time public reaction and awareness uplift.

- Tesla: Benefits significantly from tracking unprompted online discussions. As a brand that historically relies less on traditional advertising, monitoring organic conversations is crucial for understanding its awareness levels, driven primarily by product innovation, news coverage, and CEO activity.

- Oreo: The famous "Dunk in the Dark" tweet during the 2013 Super Bowl blackout was a masterclass in leveraging real-time social listening. They monitored the event, recognized the opportunity instantly, and reacted, demonstrating acute brand awareness and generating massive further awareness.

Pros and Cons:

-

Pros:

- Captures natural, unsolicited brand awareness.

- Provides continuous, real-time measurement rather than point-in-time snapshots.

- Offers rich contextual data about how brands are perceived, not just if they are known.

- Can detect emerging trends, competitor moves, or potential crises very quickly.

- Generally less expensive than conducting large-scale, continuous survey research.

-

Cons:

- Only measures awareness among the digitally vocal population, potentially underrepresenting demographics with lower online activity.

- Can sometimes exhibit a negative skew, as dissatisfied customers may be more motivated to post online (complaint bias).

- Requires effort to separate meaningful signals from irrelevant noise, especially for brands with common names or high mention volumes.

- Challenges exist in accurately distinguishing brand names from homonyms or common words (e.g., "Apple" the company vs. "apple" the fruit).

- Misses conversations happening in private channels (DMs, closed groups, offline).

When and Why to Use This Approach:

Employ social media listening when you need an ongoing, qualitative understanding of your brand's visibility and reputation in the public digital sphere. It's particularly valuable for:

- Continuous Monitoring: Tracking baseline awareness and detecting shifts over time.

- Campaign Measurement: Assessing the immediate buzz and impact of marketing initiatives.

- Competitive Intelligence: Understanding competitor visibility, strategies, and public perception (Share of Voice).

- Crisis Management: Early detection of negative sentiment or emerging issues.

- Market Research: Identifying unmet needs, customer pain points, or emerging trends discussed organically.

- Influencer Identification: Finding individuals who are already talking about your brand or industry.

For large corporations, it provides essential reputation management insights. For tech startups and VCs, it offers a cost-effective way to gauge market traction and perception. For marketing teams and event coordinators, it delivers real-time feedback crucial for optimization.

Actionable Tips for Effective Implementation:

-

Craft Precise Queries: Utilize Boolean operators (AND, OR, NOT, proximity operators) to create highly specific search strings that capture relevant mentions while excluding noise. For instance,

("Your Brand" OR YourBrandHandle) AND (review OR experience OR issue) NOT (Unrelated Homonym). - Track Variations: Include common misspellings, abbreviations, product names, and key personnel names in your monitoring setup. Track mentions both with and without official campaign hashtags.

- Filter Rigorously: Regularly review mentions and refine filtering rules to eliminate irrelevant results (e.g., job postings, spam, homonyms).

- Benchmark Performance: Don't just look at absolute numbers. Compare mention volume, sentiment, and SoV against historical data, competitor performance, and industry benchmarks. Correlate spikes with specific events (e.g., product launches, PR).

- Segment Your Analysis: Break down data by platform (Twitter vs. Blogs vs. News), language, geography, or topic to uncover deeper insights into audience behaviour and specific conversation drivers.

Social media listening provides a dynamic and context-rich method to measure brand awareness that complements other quantitative approaches. For a deeper dive into optimizing your listening strategy, you might want to Learn more about Social Media Listening and Mention Analysis.

5. Search Volume Analysis

Search Volume Analysis is a powerful quantitative method used to measure brand awareness by tracking the frequency with which consumers search for specific brand-related terms online. Essentially, it leverages data directly from search engines like Google to gauge how many people are actively seeking information about your brand, products, or services. This approach moves beyond passive recognition, tapping into tangible user behavior and intent, making it a crucial component of any comprehensive brand measurement strategy.

This method earns its significant place in our list because it reflects active consumer interest, not just passive recall often measured by surveys. When someone types your brand name or related terms into a search bar, it signals a conscious level of awareness coupled with a desire to learn more, engage, or potentially purchase. This behavioral data provides a direct, objective indicator of how top-of-mind your brand is for those actively exploring solutions or information within your market.

How it Works and Key Features

The process involves utilizing specialized tools to monitor the number of searches for your brand name and relevant variations over time. These tools aggregate anonymized search data, allowing marketers to identify patterns and trends. Key features of this methodology include:

- Direct Brand Name Search Tracking: Monitoring the search volume specifically for your core brand terms (e.g., 'YourCompanyName', 'YourProduct').

- Search Volume Trend Analysis: Identifying spikes, dips, or steady growth/decline in search interest over specific periods (daily, weekly, monthly, yearly). This helps correlate awareness shifts with market events or campaigns.

- Related and Suggested Query Analysis: Understanding what else people search for in conjunction with your brand (e.g., 'YourBrand reviews', 'YourBrand vs Competitor', 'YourBrand pricing'). This provides valuable insights into user intent, perception, and the competitive landscape.

- Geographic and Temporal Breakdowns: Pinpointing where (country, region, city) and when (time of day, day of week, seasonality) brand awareness and interest are highest or experiencing changes.

- Competitive Benchmarking: Directly comparing your brand's search volume against key competitors to understand relative awareness, market share of voice online, and interest trends.

Advantages and Disadvantages

Like any measurement technique, Search Volume Analysis comes with its own set of strengths and weaknesses:

Pros:

- Indicates Active Interest: Measures people actively seeking information, suggesting stronger intent than passive awareness.

- Objective Behavioral Data: Based on actual user actions, reducing the subjectivity and potential biases found in survey responses.

- Granular Temporal Data: Offers insights into awareness shifts on a daily or weekly basis, ideal for tracking campaign impact in near real-time.

- Geographic Segmentation: Allows for precise identification of regional variations in brand awareness and interest.

- Relatively Low Cost: Many basic trend analyses can be performed using free tools like Google Trends, making it accessible compared to large-scale primary research.

Cons:

- Measures Active Searchers Only: Doesn't capture brand awareness among individuals who aren't actively searching online (e.g., awareness driven purely by offline advertising).

- Doesn't Distinguish Sentiment: High search volume could be driven by negative news or controversy, not just positive interest. Contextual analysis is crucial.

- Ambiguity of Search Terms: Brands with generic names or multiple meanings (e.g., 'Apple' the company vs. 'apple' the fruit) can face challenges with data accuracy if not carefully filtered and segmented.

- Primarily Captures Online-Savvy Demographics: May underrepresent awareness among populations less active online.

- Relative vs. Absolute Volume: Tools like Google Trends provide indexed or relative popularity scores, not exact search counts. Paid tools (SEMrush, Ahrefs) offer volume estimations, but these are still approximations.

Examples of Implementation

Leading companies across various sectors utilize search volume analysis strategically:

- Tech Giants (e.g., Samsung vs. Apple): Both companies meticulously track search volume spikes for their brand names and specific product models (e.g., 'iPhone 15', 'Galaxy S24') during launch events and key promotional periods to gauge initial consumer excitement and compare performance against each other.

- Streaming Services (e.g., Disney+): When launching in new international markets, Disney+ monitors the growth trajectory of its brand searches ('Disney+ subscription', 'Disney+ shows') to measure brand awareness uptake and assess market penetration speed.

- Fitness Brands (e.g., Peloton): Peloton analyzes search trends for terms like 'Peloton bike' or 'Peloton classes' during peak seasons (like New Year's resolutions) or alongside major advertising campaigns to evaluate marketing effectiveness in driving active consumer interest.

Actionable Tips for Effective Use

To maximize the value of search volume analysis for measuring brand awareness:

- Track Broadly and Specifically: Monitor your core brand name, key product names, and common variations or misspellings. Also include branded searches with modifiers (e.g., 'YourBrand software demo', 'YourBrand careers', 'YourBrand coupon').

- Correlate with Marketing Activities: Overlay search volume trend data with your marketing calendar (campaign flights, product launches, PR announcements, major events) to directly assess the impact on public interest.

- Use Normalized Data for Comparisons: When comparing search interest across different geographic regions or long time periods, utilize normalized index data (like that from Google Trends) to account for varying population sizes or overall search activity levels.

- Establish Regular Reporting: Implement weekly or monthly checks and set up alerts for significant changes (spikes or drops) to quickly identify opportunities or potential issues.

- Analyze Search Intent via Related Queries: Don't just look at volume; examine the related and suggested searches provided by tools. This helps understand why people are searching – are they researching, comparing, looking for support, or ready to buy?

When and Why to Use This Approach

Search Volume Analysis is particularly valuable for:

- Post-Campaign Analysis: Quickly assessing if marketing campaigns, sponsorships, or PR efforts have increased the number of people actively seeking out your brand.

- Competitive Intelligence: Continuously monitoring your brand's online interest relative to competitors.

- Market Entry & Expansion: Gauging initial awareness and tracking growth in new geographic or demographic segments.

- Product Launch Monitoring: Measuring initial buzz and sustained interest following a new product release.

- Identifying Seasonality & Trends: Understanding natural fluctuations in interest related to your brand or industry.

It provides a cost-effective, data-driven pulse check on how actively your target audience – from potential enterprise clients for Fortune 100s and Tech Startups to investors sought by VCs – is thinking about and looking for your brand online. This methodology has been widely adopted thanks to platforms like Google Trends, SEMrush, and Ahrefs, and is frequently discussed by digital marketing thought leaders such as Rand Fishkin and Neil Patel.

For organizations looking to integrate this method into their measurement framework, understanding the nuances of the available tools and data interpretation is key. Learn more about Search Volume Analysis and explore how different platforms can provide actionable insights.

Okay, here is the detailed section for item #6, Brand Salience Research, formatted in Markdown and optimized as requested.

6. Brand Salience Research

Moving beyond simple recognition, Brand Salience Research is a critical method used to measure brand awareness within the specific contexts that trigger purchase decisions. It shifts the focus from whether consumers know your brand exists to whether they think of your brand in relevant buying or usage situations. At its core, salience measures a brand's 'mental availability' – its prominence in a consumer's mind precisely when they are considering a category purchase.

Why It Deserves Its Place:

Simple awareness (aided or unaided recall) is often a poor predictor of actual sales. A consumer might know dozens of car brands, but only a few will spring to mind when they actively start shopping for an SUV, need urgent repairs, or look for a fuel-efficient commuter car. Brand Salience Research directly addresses this gap by measuring awareness within these crucial 'Category Entry Points' (CEPs). It acknowledges that brands aren't just bought in a vacuum; they are chosen in response to specific needs, occasions, or problems. Therefore, measuring awareness in these contexts provides a much more accurate indicator of market strength and potential purchase behavior than general awareness metrics alone. For sophisticated marketing teams in Fortune 100 companies, tech startups aiming for disruption, or VCs evaluating market potential, understanding salience is key to understanding true competitive positioning.

How It Works:

Brand Salience Research typically employs a mix of qualitative and quantitative methodologies:

- Identifying Category Entry Points (CEPs): The first step involves identifying the key situations, needs, feelings, or tasks that prompt consumers to think about the category (e.g., "feeling thirsty on a hot day," "need a quick lunch near the office," "planning a family vacation," "looking for software to improve team collaboration"). This often involves initial qualitative research like focus groups or in-depth interviews.

- Contextual Questioning: Surveys or interviews then probe brand recall specifically linked to these CEPs. Instead of asking "What soft drink brands are you aware of?", the question becomes "When you're looking for a refreshing drink after exercising, which brands come to mind?"

- Measuring Associations: It examines the strength of association between the brand and specific usage occasions or purchase triggers. Does your target audience associate your brand strongly with the most frequent or valuable CEPs?

- Quantifying Share of Mind: Researchers measure how often a brand is mentioned relative to competitors within each specific context, providing a contextual 'share of mind'.

- Analysis: Data is analyzed to see which brands are most salient for which CEPs, revealing competitive landscapes within micro-moments of the purchase journey.

Features & Benefits:

- Contextual Awareness Measurement: Goes beyond generic recall to assess presence in real-world purchase scenarios.

- CEP Identification: Pinpoints the specific triggers that lead consumers into the market.

- Usage Occasion Association Testing: Reveals how strongly consumers link your brand to relevant situations.

- Situational Share of Mind: Assesses competitive standing within specific contexts, not just overall.

- Actionable Targeting Insights: Identifies the specific contexts (CEPs) where the brand is strong or weak, allowing for highly targeted marketing messages and media placement. For example, if salience is low for the "quick weeknight meal" CEP, messaging can be adjusted accordingly.

- Stronger Purchase Prediction: Salience is considered a better predictor of purchase likelihood than general awareness because it measures recall at the point of decision relevance.

- Competitive Context: Uncovers not just who the competitors are, but in which specific situations they are strongest.

- Funnel Connection: Directly links top-of-funnel awareness metrics to mid-funnel consideration driven by specific needs.

Pros:

- Provides deeper, more actionable insights than basic awareness tracking.

- Directly links brand thoughts to potential purchase triggers.

- Helps optimize marketing creative and media buying for specific situations.

- Reveals nuanced competitive strengths and weaknesses across different contexts.

- Aligns awareness measurement more closely with actual consumer behavior.

Cons:

- Significantly more complex and resource-intensive to design and execute than standard awareness surveys.

- Requires careful and accurate definition of relevant Category Entry Points, which can be challenging.

- Analyzing and standardizing data across multiple contexts can be complex.

- May require larger sample sizes to achieve statistical significance for each defined context, increasing costs.

When and Why to Use This Approach:

Brand Salience Research is particularly valuable when:

- You need to understand why high general awareness isn't translating into desired market share.

- Operating in a mature or highly competitive market where differentiation within specific usage occasions is key.

- Planning targeted marketing campaigns aimed at specific consumer needs or moments (e.g., time of day, specific problem).

- Seeking to grow market share by identifying and strengthening associations with under-leveraged Category Entry Points.

- Evaluating the effectiveness of campaigns designed to link the brand to new usage situations.

- Venture Capital firms might use this to assess if a startup truly understands the specific triggers for its target market, beyond just general category awareness.

Examples:

- Snickers: Successfully built salience around the "hunger," "low energy," or "feeling irritable" moments, effectively owning the "You're not you when you're hungry" CEP. Their research would measure brand awareness specifically within these hunger-related contexts.

- Uber: Tracks salience not just for "ride-sharing," but for specific CEPs like "need a ride to the airport," "going out at night," "need transport quickly after an event," comparing recall against taxis, public transport, and other apps in each situation.

- Procter & Gamble (Tide): Measures Tide's salience across various laundry challenges – "removing tough stains," "keeping whites white," "washing delicates," "energy-efficient washing" – understanding where it dominates recall and where competitors might have an edge.

Actionable Tips for Implementation:

- Rigorously Define & Test CEPs: Ensure your defined contexts are distinct, relevant to consumers, and cover the most important purchase triggers. Validate them through preliminary qualitative research.

- Use Realistic Scenarios: Frame questions around relatable situations rather than abstract concepts. "Imagine you've just finished a workout..." is better than "When do you think about hydration?"

- Segment Your Results: Analyze salience across different user segments (e.g., demographics, existing customers vs. non-customers, category involvement levels).

- Track Over Time: Monitor changes in brand salience for key CEPs, especially before and after specific marketing campaigns designed to influence those associations.

- Benchmark Against Competitors: Always measure competitor salience within the same defined contexts to understand your relative mental availability.

Popularized By:

The concept of brand salience and mental availability has been significantly advanced by the work of Professor Byron Sharp (author of How Brands Grow), the Ehrenberg-Bass Institute for Marketing Science, and related research by figures like Karen Nelson-Field on media's role in building mental availability. Their work emphasizes building broad reach and consistent memory structures linked to CEPs as the foundation for brand growth.

In summary, Brand Salience Research offers a sophisticated and highly insightful way to measure brand awareness. By focusing on mental availability within specific purchase contexts, it provides a clearer picture of a brand's true strength in the marketplace and delivers actionable insights for driving growth.

Okay, here is the detailed section for item #7, "A/B Testing for Brand Elements," formatted in Markdown and optimized as requested.

7. A/B Testing for Brand Elements

Moving beyond surveys and social listening, A/B testing offers a rigorous, experimental method to measure brand awareness impact directly tied to specific brand assets. It involves systematically comparing two or more versions (A vs. B, or even A/B/n) of a brand element – such as a logo, color palette, tagline, or messaging style – to determine empirically which version performs better against predefined awareness-related Key Performance Indicators (KPIs).

How It Works:

The core principle is controlled experimentation. A target audience segment is randomly divided into groups. Each group is exposed to a different version of the brand element being tested (e.g., Group A sees the current logo, Group B sees a proposed new logo). The key is then to measure the impact of each variation on metrics directly or indirectly related to brand awareness. This could involve:

- Recognition Tests: Showing participants the element (e.g., a logo in context) and measuring how quickly or accurately they identify the brand.

- Recall Tests: Asking participants (aided or unaided) to recall the brand after exposure to specific messaging or visuals.

- Surveys: Directly asking participants exposed to different versions about brand perception, clarity of message, or memorability.

- Behavioral Metrics: Tracking proxy indicators like click-through rates on branded ads, engagement rates with branded content, or conversion rates where brand trust is a factor.

By comparing the results between the control group (A) and the variant group(s) (B, C, etc.), marketers can statistically determine which version more effectively captures attention, sticks in memory, or communicates the intended brand message, thereby influencing awareness.

Why This Approach Deserves Its Place:

A/B testing earns its spot in any serious discussion about how to measure brand awareness because it provides causal insights, not just correlations. While other methods might show a correlation between a campaign and awareness shifts, A/B testing can directly attribute differences in awareness metrics to specific changes in brand elements. This is invaluable for making high-stakes branding decisions with data-driven confidence, moving beyond subjective opinions or gut feelings. For Fortune 100 companies refining global brands or tech startups needing to make impactful choices quickly, this method provides objective validation.

Features & Benefits:

- Direct Comparison: Tests different versions of brand elements head-to-head in a controlled environment. Benefit: Provides clear, objective data on which option performs better according to your specific goals.

- Measures Impact on KPIs: Quantifies the effect of changes on recognition, recall, perception, or behavioral metrics. Benefit: Allows for ROI calculation on creative changes and demonstrates tangible impact.

- Versatile Application: Can be conducted across various touchpoints – website elements, in-app messages, email campaigns, ad creatives, and even simulated physical environments (like shelf tests for packaging). Benefit: Enables testing in the context where the brand element will actually live.

- Data-Driven Optimization: Provides empirical evidence to guide brand development. Benefit: Minimizes risk associated with major rebrands or new message launches by validating choices before full-scale implementation.

- Iterative Improvement: Supports a continuous cycle of testing and refining brand elements over time. Benefit: Particularly valuable for agile marketing teams and startups looking to constantly optimize their brand presence.

Examples of Successful Implementation:

- Slack (Logo Redesign 2019): Before launching their significantly different new logo, Slack likely conducted extensive testing (including A/B or multivariate methods) to gauge recognition, perception, and ensure the new design resonated positively with users, mitigating potential backlash.

- Mailchimp (Brand Voice): A company known for its distinct voice, Mailchimp could use A/B testing in email subject lines or onboarding messages to see which tone (e.g., quirky vs. straightforward) leads to higher engagement or better reflects their desired brand personality, indirectly influencing brand perception and recall.

- Tropicana (Packaging Redesign): While famous for the negative outcome, the Tropicana packaging redesign highlights the importance of testing. Post-launch backlash due to decreased recognition could potentially have been predicted and avoided if A/B testing or similar research measuring visual recognition and purchase intent had been conducted beforehand comparing the old and new designs.

Pros:

- Provides causal data, showing why one element works better.

- Offers direct, objective comparison of specific creative options.

- Allows optimization before costly full-scale rollouts, reducing risk.

- Minimizes subjective decision-making in brand creative development.

- Can be implemented iteratively for continuous brand improvement.

Cons:

- Often tests elements in isolation, potentially missing synergistic or conflicting effects between multiple brand elements.

- Requires sufficient traffic or a large enough sample size for statistically significant results, which can be a barrier for smaller audiences or niche products.

- Short-term tests might not capture long-term effects on brand equity or perception.

- Can be technically complex to set up and execute correctly, especially multivariate tests.

- May create temporary brand inconsistencies for users exposed to different variations during the testing phase.

Actionable Tips for Implementation:

- Isolate Variables: Test only one element change at a time (e.g., change the color or the tagline, not both) to accurately attribute performance differences.

- Ensure Statistical Significance: Use A/B testing calculators and run tests long enough to gather sufficient data for reliable conclusions. Avoid making decisions based on small sample sizes or short durations.

- Define Success Clearly: Establish specific, measurable KPIs before starting the test. What exactly constitutes "better awareness" (e.g., 10% higher recall rate, 5% faster recognition)?

- Consider Long-Term Effects: While measuring immediate impact is useful, supplement A/B test results with qualitative insights or longer-term tracking to understand the broader implications for brand health.

- Segment Your Audience: Analyze results not just overall, but across key audience segments (e.g., new vs. existing customers, different demographics) as responses to brand elements can vary significantly.

When and Why to Use A/B Testing for Brand Elements:

Use this method when you need to make objective decisions about specific, tangible brand assets and want to directly measure the impact of those choices on how your audience perceives or recognizes your brand. It's particularly valuable:

- Before launching a major rebrand (logo, visual identity).

- When developing new messaging frameworks or taglines.

- To optimize call-to-action buttons or other branded conversion points.

- When choosing between different creative executions for an advertising campaign.

- To settle internal debates about creative choices with empirical data.

For organizations like Fortune 100s managing vast brand equity, tech startups needing efficient brand building, corporate marketing teams justifying creative spend, and VCs assessing brand potential, A/B testing provides a crucial layer of data-driven validation for brand strategy.

(Note: While no specific website link represents the concept itself, platforms like Optimizely, VWO, and methodologies championed by experts like Ron Kohavi or Google's Brand Lab are central to its popularization and execution.)

8. Eye-Tracking and Neuroscience Methods

Venturing beyond what consumers say they perceive, eye-tracking and neuroscience methods offer a direct window into how they actually process brand information physiologically and neurologically. These advanced techniques move past self-reported data, which can be influenced by conscious biases or poor recall, to measure brand awareness based on automatic, often subconscious, responses. This focus on objective, biological data earns its place on this list as a powerful, albeit resource-intensive, way to gain deep insights into brand perception.

How It Works:

At its core, this approach uses specialized technologies to monitor involuntary biological signals as individuals are exposed to brand stimuli (logos, ads, packaging, websites, etc.). Key methods include:

- Eye-Tracking: Utilizes hardware (often glasses or screen-based trackers) to monitor precisely where a person is looking, for how long (fixations), and the path their eyes take (saccades). This reveals which brand elements capture attention, which are ignored, and the sequence in which information is processed. Heatmaps and gaze plots visually represent this attention data.

- Electroencephalography (EEG): Measures electrical activity in the brain via sensors placed on the scalp. Different patterns of brainwaves can indicate levels of engagement, emotional valence (positive/negative response), cognitive load, and memory encoding when encountering brand elements.

- Functional Magnetic Resonance Imaging (fMRI): Tracks changes in blood flow within the brain. While highly expensive and typically used in academic settings, fMRI can pinpoint activity in specific brain regions associated with emotion, reward, decision-making, and memory formation related to brands.

- Facial Coding: Uses cameras and software to analyze micro-expressions on a person's face, identifying fleeting emotional responses (happiness, surprise, confusion, disgust) that participants might not consciously register or report.

- Biometric Sensors: May include measurement of heart rate variability (HRV), galvanic skin response (GSR - indicating arousal/emotional intensity), and respiration rate to gauge physiological reactions to brand exposure.

By integrating these data streams, researchers can build a detailed picture of implicit brand recognition, emotional engagement, and the likelihood that brand information will be effectively stored in memory.

Features and Benefits:

- Objective Measurement: Relies on physiological data, significantly reducing the self-reporting biases found in surveys or focus groups.

- Implicit Insights: Taps into unconscious, automatic processing, revealing gut reactions and perceptions that consumers may be unable or unwilling to articulate.

- Granular Attention Data: Eye-tracking pinpoints exactly which visual elements (logo, headline, call-to-action) attract or fail to attract attention, crucial for optimizing design.

- Emotional Resonance: Techniques like EEG and facial coding can detect nuanced emotional responses, providing deeper insights than simple "like/dislike" scales.

- Memory Encoding Analysis: Helps understand how effectively brand messages and visuals are being processed and stored, a key component of lasting brand awareness.

When and Why Use This Approach:

Eye-tracking and neuroscience methods are most valuable when:

- You need highly objective data to complement or validate traditional survey findings.

- Understanding subconscious drivers of brand perception is critical (e.g., luxury goods, health products).

- Optimizing the visual effectiveness of packaging, advertising creative, shelf placement, or user interface design is a primary goal.

- Testing subtle variations in branding where conscious feedback might be unreliable.

- Seeking a competitive edge through deeper consumer understanding, particularly relevant for Fortune 100 companies and innovative tech startups.

Examples of Successful Implementation:

- Coca-Cola: Has employed eye-tracking studies to optimize the placement of its products on store shelves and ensure packaging designs quickly capture shopper attention in cluttered retail environments.

- Campbell's Soup: Famously utilized neuroscience insights, including eye-tracking and biometrics, to guide a major label redesign, aiming for greater emotional connection and easier visual processing by consumers.

- Nielsen Consumer Neuroscience: Regularly conducts studies using EEG and other techniques to assess the moment-by-moment effectiveness of television commercials and digital advertising for major brands.

Pros:

- Minimizes participant bias for more objective results.

- Measures automatic, often unconscious, brand processing.

- Provides precise, quantitative data on visual attention.

- Can detect subtle emotional responses.

- Offers insights into memory formation related to the brand.

Cons:

- Requires significant investment in specialized equipment and trained expertise.

- Studies often involve smaller sample sizes due to cost and complexity.

- Controlled laboratory settings may not perfectly replicate real-world brand encounters.

- Interpreting complex neurological and physiological data requires sophisticated analysis.

- Ethical considerations regarding the collection and use of neurological data must be carefully managed.

Actionable Tips for Readers:

- Integrate, Don't Isolate: Combine neuroscience findings with traditional methods (surveys, interviews) for a holistic understanding and validation.

- Standardize Protocols: Use consistent methodologies and stimuli presentation to ensure reliable and comparable results across studies.

- Strive for Realism: Whenever possible, test brand elements within realistic contexts (e.g., simulated store shelves, actual website interfaces) rather than in isolation. Consider mobile eye-tracking for more naturalistic settings.

- Define Clear Objectives: Focus research on specific, answerable questions (e.g., "Does logo placement X improve recall compared to placement Y?") rather than broad explorations.

- Partner with Experts: Collaborate with experienced research firms or consultants specializing in consumer neuroscience and eye-tracking.

Given the complexity and specialized nature of these techniques, thorough planning and expert interpretation are essential. Learn more about Eye-Tracking and Neuroscience Methods to explore the nuances further.

In summary, for organizations like Fortune 100 companies, ambitious tech startups, and data-driven corporate marketing teams seeking the deepest level of understanding of how their brand resonates at a subconscious level, eye-tracking and neuroscience offer powerful, objective tools to measure brand awareness and optimize marketing effectiveness.

8 Brand Awareness Measurement Methods Comparison

| Strategy | 🔄 Implementation Complexity | 🛠️ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Aided Brand Recall Surveys | Low - straightforward survey setup | Low - basic survey tools, moderate sample | Moderate - measures brand recognition | Quick brand recognition assessment, competitor comparisons | Easy to administer; low respondent burden; quantifiable data |

| Unaided Brand Recall Surveys | Medium - requires open-ended data coding | Medium - skilled coders, longer surveys | High - measures spontaneous recall and top-of-mind awareness | Deep awareness and brand strength measurement | Strong predictor of purchase; reveals true mental positioning |

| Brand Recognition Testing | Medium-High - requires visual/audio stimuli | Medium-High - stimuli creation, possible specialized equipment | Moderate - tests visual/auditory recognition | Assessing effectiveness of brand identity elements | Less biased than recall; guides brand asset optimization |

| Social Media Listening | Medium - requires setup of monitoring tools | Medium - software subscriptions, skilled analysts | Moderate-High - real-time tracking and sentiment insights | Monitoring organic brand conversations and trends | Continuous data flow; cost-effective; context-rich insights |

| Search Volume Analysis | Low - setup with existing tools | Low - SEO/analytics tools subscription | Moderate - tracks active interest via search trends | Measuring active brand interest online | Objective behavioral data; granular temporal/geographic insights |

| Brand Salience Research | High - complex design with contextual scenarios | High - large samples, mixed methods | High - measures brand prominence in purchase situations | Understanding brand prominence in buying contexts | Better purchase predictor; actionable marketing insights |

| A/B Testing for Brand Elements | Medium-High - requires testing infrastructure | Medium-High - sample size, analytic tools | High - causal insights on brand element effectiveness | Optimizing brand assets pre-launch | Provides causal data; iterative improvement; reduces guesswork |

| Eye-Tracking & Neuroscience | High - specialized equipment & expertise | High - costly hardware and skilled staff | High - objective physiological brand engagement data | Deep unconscious brand processing and attention analysis | Reduces bias; measures implicit reactions; precise attention data |

Choosing Your Toolkit: Which Methods Fit Best?

As we've explored, the landscape of tools to measure brand awareness is diverse and powerful. From gathering direct feedback via aided and unaided recall surveys and recognition tests, to observing organic behavior through social media listening and search volume analysis, and even delving into advanced techniques like brand salience research, A/B testing, and neuroscience methods, there's no single perfect method. The most crucial insight is that a tailored, multi-faceted approach yields the clearest picture of your brand's visibility and resonance in the market.

The key takeaway is that effective measurement requires strategic selection and consistency. Your ideal toolkit will likely blend several techniques, chosen specifically based on your core objectives, target audience (whether broad consumers or niche B2B segments), and available resources. Remember, consistent tracking over time is essential not just for reporting, but for truly understanding trends, gauging the impact of your marketing campaigns, and identifying areas for improvement.

So, what are your actionable next steps?

- Define Your Goals: Clearly articulate what aspect of awareness you need to understand most urgently (e.g., top-of-mind recall, recognition within a specific vertical, share of voice against competitors).

- Select Your Methods: Choose a combination of the approaches discussed that align with your goals and budget. Start perhaps with foundational methods like surveys or social listening, and consider adding more sophisticated techniques as needed.

- Establish Baselines & Track: Implement your chosen methods and commit to regular measurement cycles to monitor progress and evaluate the effectiveness of your strategies.

- Analyze & Adapt: Use the data gathered to gain actionable insights. Don't just collect numbers; understand what they mean for your marketing spend, messaging, channel strategy, and even product presentation.

Mastering how to effectively measure brand awareness provides invaluable strategic intelligence. It empowers Fortune 100 giants, agile Tech Startups, Corporate Marketing Teams, discerning Venture Capital Firms, and meticulous Event Coordinators alike to optimize marketing investments, justify budgets, build stronger audience connections, and ultimately solidify their brand's competitive standing. Understanding your brand's presence isn't just a reporting function; it's a fundamental driver of informed decision-making and sustainable growth. By equipping yourself with the right measurement tools and insights, you're not just tracking visibility – you're actively shaping your brand's future success.

Ensuring every brand touchpoint reflects quality is crucial for building positive awareness and recognition. For physical products, displays, or high-impact marketing materials where premium presentation matters, the finish is paramount. Explore how expert finishing can elevate your brand's tangible presence and perceived value with Electronic Finishing Solutions.