Due diligence is the bedrock of any successful merger, acquisition, or significant investment. It's a comprehensive investigation that uncovers liabilities, assesses risks, and verifies critical information before a deal is finalized. A flawed process can lead to disastrous outcomes, while a thorough one paves the way for a seamless transaction and confident decision-making. The key to a meticulous review is a structured, comprehensive due diligence checklist template.

But with countless options available online, finding the right one for your specific needs, whether it's for M&A, real estate, or venture capital funding, can be overwhelming. This guide cuts through the noise. We've curated and analyzed the 12 best resources for 2025, from simple downloadable documents to powerful, integrated software platforms. Each entry includes a direct link, an honest assessment of its strengths and limitations, and practical guidance on its best use case.

While these templates cover general, financial, and legal aspects, remember that specialized checklists are often necessary. For instance, a comprehensive tax checklist is crucial for any deep financial review. Our goal is to equip you with the perfect tool to streamline your process and ensure no stone is left unturned in your next big move.

1. Demand Metric

Demand Metric provides a robust and comprehensive due diligence checklist template specifically engineered for mergers and acquisitions (M&A). What sets this resource apart is its sheer depth, featuring over 200 distinct line items across critical business functions. This makes it an ideal starting point for corporate development teams, venture capital firms, and established companies engaging in significant transactions where no detail can be overlooked.

The template is delivered as a Microsoft Excel file, allowing for extensive customization. Users can easily add, remove, or modify checklist items to align with the specific nuances of their deal, whether it involves intellectual property-heavy tech startups or established manufacturing firms.

Key Features & Considerations

- Scope: Covers accounting, finance, legal, tax, HR, IT, and intellectual property.

- Format: Downloadable and fully editable Microsoft Excel spreadsheet.

- Best For: Medium-to-large scale acquisitions requiring an exhaustive review process.

- Limitation: Accessing this template requires a Demand Metric membership. While this presents a barrier, the quality and thoroughness of the document justify the access requirement for serious M&A activities. For smaller, less complex deals, the level of detail might be excessive.

Practical Tip: Upon downloading, immediately save a master copy. Then, create a working version and use Excel's filtering or conditional formatting features to assign specific sections to different teams (e.g., finance, legal) to streamline the diligence process.

Access the Template on Demand Metric

2. Ansarada

Ansarada offers a highly focused Legal Due Diligence Checklist template, distinguished by its data-driven foundation. Developed from insights across more than 50 million data points from real deals, this resource is engineered to help legal teams and dealmakers structure critical business information with precision. It is an excellent tool for organizations preparing for an M&A event, fundraising round, or internal audit, ensuring key legal risks are identified early.

The checklist is provided as a free download, making it accessible to companies of any size. While the template itself is a static document, it serves as a gateway to Ansarada's broader platform, where the process can be automated and managed within a secure virtual data room environment. This positions the template as both a standalone resource and a strategic first step toward a more integrated due diligence workflow.

Key Features & Considerations

- Scope: Concentrates on legal aspects, including corporate structure, contracts, litigation, compliance, and IP.

- Format: Downloadable file, adaptable for various legal review scenarios.

- Best For: Companies needing a specialized legal due diligence checklist template to prepare for a transaction or audit.

- Limitation: The free template is specifically for legal due diligence and does not deeply cover operational or financial areas. Users seeking a comprehensive, all-in-one checklist may need to supplement it with other resources. The advanced automation features require using Ansarada's paid platform.

Practical Tip: Use this template proactively, even before a deal is on the horizon. Completing it helps organize your legal documents and information, effectively creating a "deal-ready" state that can significantly accelerate future transaction timelines.

Access the Template on Ansarada

3. SafetyCulture

SafetyCulture offers a highly accessible and mobile-first due diligence checklist template geared toward on-the-go professionals. What makes this platform unique is its emphasis on operational audits and risk assessment from a practical, field-level perspective. The template guides users through evaluating company profitability, legal compliance, and potential risks, making it an excellent tool for initial screenings or for teams that conduct due diligence on-site.

The platform's strength is its user-friendly, mobile-native interface. This allows diligence teams to complete checklists directly on tablets or smartphones, capture photo evidence, and assign corrective actions in real-time. This functionality is particularly useful for assessing physical assets, operational workflows, or safety compliance as part of the broader due diligence process.

Key Features & Considerations

- Scope: Focuses on financial assessments, legal compliance, operational workflows, and risk analysis.

- Format: Digital checklist usable on mobile devices, with options to download a PDF report.

- Best For: Preliminary due diligence, operational audits, and teams requiring mobile access for on-site inspections.

- Limitation: While free to access, the template is more general and may lack the deep financial or legal specificity required for complex M&A deals without significant customization. It's best used as a foundational tool rather than an exhaustive, all-in-one solution.

Practical Tip: Use the mobile app to conduct initial site visits. Assign different sections of the checklist to team members and leverage the platform's reporting features to quickly generate a preliminary findings report, complete with photos and notes, to share with stakeholders.

Access the Template on SafetyCulture

4. Meegle

Meegle offers a free, highly structured due diligence checklist template designed as a collaborative tool rather than a simple document. What makes it unique is its platform-based approach, which is ideal for small to mid-sized teams managing transactions in real estate, mergers, or acquisitions. It moves beyond a static spreadsheet, providing a dynamic workspace to assign tasks and track progress.

The template is built to facilitate comprehensive data gathering in a shared environment. Its user-friendly interface allows for straightforward customization of fields and workflows, making it adaptable for various deal types without requiring advanced technical skills. This focus on usability and collaboration sets it apart for teams needing a central hub for their diligence efforts.

Key Features & Considerations

- Scope: Focuses on mergers, acquisitions, and real estate transactions.

- Format: Interactive, web-based platform with customizable fields and workflows.

- Best For: Small to mid-sized teams (up to 20 members) seeking a collaborative, all-in-one tool.

- Limitation: The free access is limited to teams of 20 members, which may not be suitable for larger corporate diligence teams. While customizable, it may require some adaptation for highly specialized or unique industry transactions.

Practical Tip: Use Meegle's platform to assign entire checklist categories (e.g., "Financials") to specific team members. Set deadlines within the tool to create a clear project timeline and use its dashboard to monitor overall progress at a glance, eliminating the need for separate project management software.

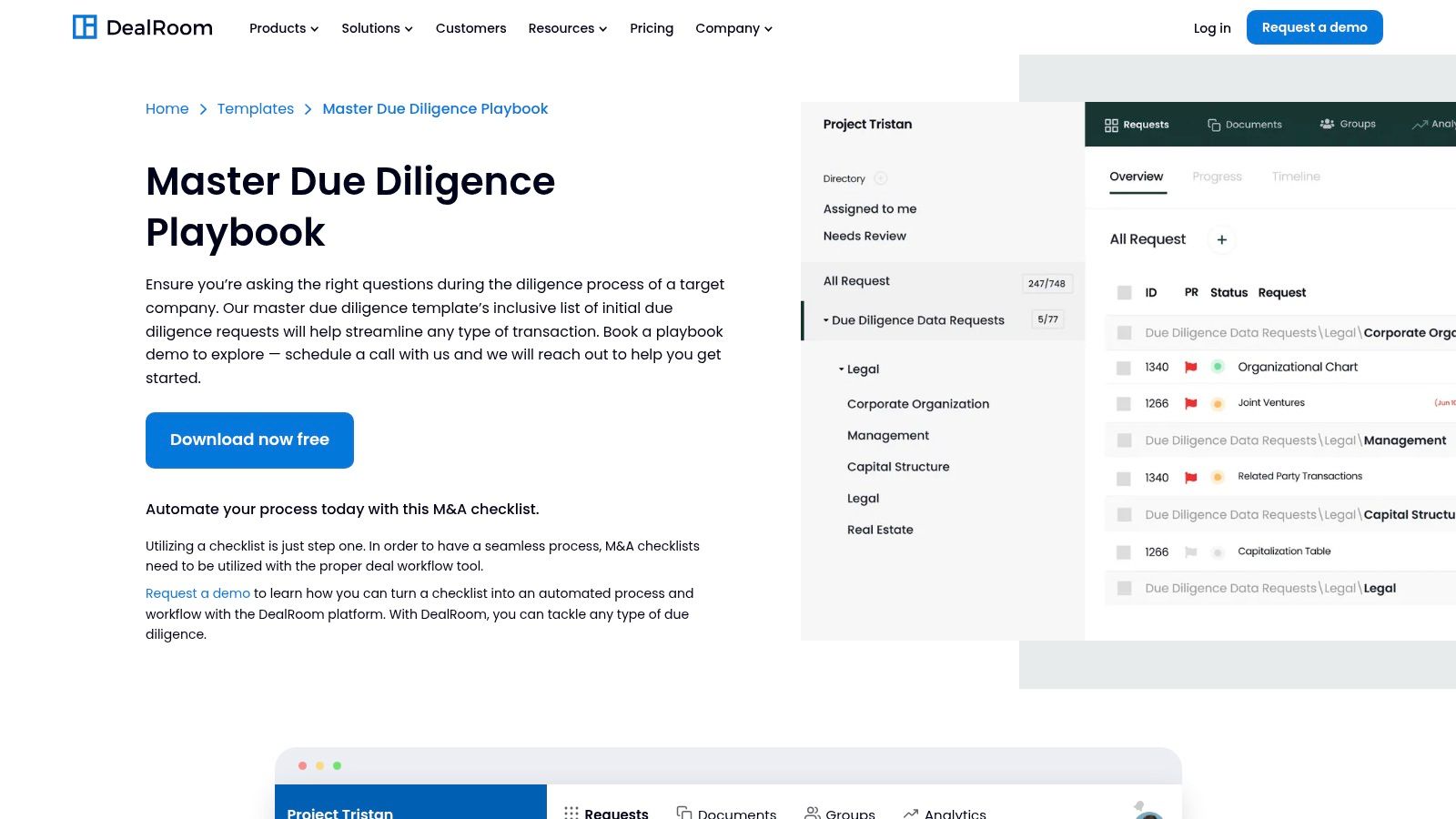

5. DealRoom

DealRoom moves beyond a simple downloadable file by offering a "Master Due Diligence Playbook," which is a comprehensive due diligence checklist template integrated directly into its virtual data room (VDR) platform. This unique fusion of checklist and workspace makes it a powerful solution for teams that want to manage the entire diligence process, from initial requests to document review and final reporting, all in one place. The platform is designed to streamline complex transactions by linking checklist items directly to required documents and tasks.

The template's integration with project management tools allows for real-time progress tracking, assignments, and communication, significantly reducing the administrative overhead often associated with M&A. This makes it an excellent choice for distributed teams and complex deals requiring tight coordination.

Key Features & Considerations

- Scope: Inclusive checklist covering legal, financial, commercial, HR, IT, and operational diligence.

- Format: Integrated within the DealRoom VDR platform; also supports Excel import and export for offline work or integration with other tools.

- Best For: Deal teams seeking an all-in-one project management and data room solution to manage the due diligence workflow efficiently.

- Limitation: While a 14-day free trial is available, full access is subscription-based. The integrated nature of the platform might present a slight learning curve for users accustomed to traditional folder-based data rooms and separate spreadsheets.

Practical Tip: Use the platform's request list feature to assign checklist items directly to counterparts. This creates a clear, trackable audit trail of all requests and responses, centralizing communication and preventing important items from getting lost in email chains.

Access the Template on DealRoom

6. PaperRock Documents

PaperRock Documents offers a highly structured due diligence checklist template specifically designed for business purchase transactions. Its primary strength lies in its legal-centric approach, making it an excellent resource for legal teams, M&A advisors, and business owners who need to conduct a thorough legal review before an acquisition. The checklist is organized in a clean, tabular format that methodically guides users through critical areas of investigation.

The template, available for immediate purchase and download, is more than just a list of items. It includes valuable explanatory guides that provide context and clarification for each section. This educational component helps ensure that users not only check boxes but also understand the significance of each diligence request, making the process more meaningful and effective.

Key Features & Considerations

- Scope: Focuses heavily on legal aspects including corporate matters, business contracts, litigation, assets, and intellectual property.

- Format: Digital download in a user-friendly, tabular format.

- Best For: Buyers, sellers, and legal counsel involved in a business purchase who require a legally robust framework.

- Limitation: This is a paid resource, and its strong legal focus means it might need to be supplemented with more detailed operational or financial checklists for a fully comprehensive, 360-degree due diligence process.

Practical Tip: Use the included explanatory guides as a training tool for junior team members. Before assigning sections, review the guides together to ensure everyone understands the legal implications and objectives behind the information being requested.

Access the Template on PaperRock Documents

7. Etsy (TerravaTemplates)

For professionals focused specifically on real estate, Etsy seller TerravaTemplates provides a surprisingly detailed and affordable due diligence checklist template. This resource proves that a marketplace known for crafts can also be a source for niche professional tools. It is designed exclusively for property acquisitions, stripping away the corporate M&A complexities to focus on what matters most in real estate transactions.

The template is a downloadable, editable Word document featuring 39 distinct categories. These cover everything from facility background and zoning compliance to title searches, operational history, and financial reviews. Its straightforward format with highlighted fields makes it exceptionally user-friendly, allowing investors or real estate agents to quickly adapt it for residential or commercial property deals.

Key Features & Considerations

- Scope: Niche focus on real estate, including facility, zoning, title, and operations.

- Format: Instantly downloadable and fully editable Microsoft Word document.

- Best For: Real estate investors, agents, and small firms needing a specialized, easy-to-use checklist.

- Limitation: This is a paid, single-use template and its scope is strictly limited to real estate. It lacks the broad corporate, legal, and HR sections found in M&A-focused templates, making it unsuitable for other types of business transactions.

Practical Tip: After downloading, customize the template for your specific property type. For example, add line items for multi-family tenant lease audits or for commercial property environmental site assessments to create a more powerful, reusable master checklist for your portfolio.

Access the Template on Etsy

8. Superdocu

Superdocu functions as a meta-resource, aggregating and reviewing various due diligence checklist templates from leading platforms. Instead of providing a single proprietary template, it curates a list of the best options from providers like Smartsheet, Monday.com, and even professional services firms like PwC. This makes it an excellent first stop for teams who are unsure which type of template best fits their specific transaction or industry needs.

The platform offers brief but insightful descriptions of each resource, helping users compare features, formats, and potential costs before committing. It effectively serves as a high-quality filter, saving valuable time by pre-vetting templates for different use cases, from startup funding rounds to major corporate acquisitions.

Key Features & Considerations

- Scope: A curated collection covering multiple industries and deal types from various trusted sources.

- Format: Acts as a directory, providing descriptions and direct links to external templates (Excel, Smartsheet, etc.).

- Best For: Teams at the beginning of their search who want to compare multiple high-quality due diligence checklist templates.

- Limitation: Superdocu is a middleman. Users must navigate to external sites to download the actual templates, some of which may require subscriptions or registrations on those third-party platforms.

Practical Tip: Use Superdocu to create a shortlist of 2-3 promising templates. Visit each source link and evaluate them based on your deal's complexity, team's software preferences (e.g., Excel vs. a project management tool), and budget.

Access the Template Collection on Superdocu

9. Consultport

Consultport offers a powerful M&A Due Diligence Kit designed for consultants, in-house corporate development teams, and dealmakers. This resource stands out by packaging a comprehensive due diligence checklist template with an accompanying report template. This dual-offering streamlines the entire process from initial data request to the final presentation of findings, making it a highly efficient tool for managing complex transactions.

The kit is structured to cover the core pillars of any major deal: commercial, financial, and operational due diligence. By providing a framework not just for investigation but also for communication, it helps ensure that critical insights are clearly articulated to stakeholders and decision-makers. The resources are delivered in an easily editable format, allowing for quick customization to fit the specific industry or deal structure.

Key Features & Considerations

- Scope: Focused on M&A, covering commercial, financial, and operational diligence.

- Format: Downloadable kit including a checklist and a separate report template.

- Best For: M&A consultants and corporate teams who need to both conduct and present their findings systematically.

- Limitation: While excellent for its intended M&A purpose, the framework is less suited for non-transactional due diligence, such as vetting a new vendor or partner, without significant modification. It is specifically a deal-focused toolkit.

Practical Tip: Use the report template from the very beginning of the due diligence process. As your team completes sections of the checklist, populate the corresponding slides in the report. This avoids a last-minute scramble and creates a living document that reflects real-time progress.

Access the Template on Consultport

10. Lumiform

Lumiform stands out by offering a free, extensive library of 27 distinct due diligence checklist templates. This collection isn't limited to a single use case; it spans a wide array of scenarios including vendor evaluations, real estate transactions, IT assessments, and comprehensive mergers and acquisitions. This diversity makes it a uniquely versatile resource for businesses needing a quick, no-cost starting point for various operational and strategic reviews.

The platform provides its templates in a user-friendly, accessible format, allowing teams to immediately implement them. For organizations that require a flexible due diligence checklist template without the barrier of a paywall or mandatory registration, Lumiform offers significant value.

Key Features & Considerations

- Scope: Covers M&A, real estate, vendors, IT, HR, and other specialized operational areas.

- Format: Digital checklists accessible directly on their platform, often available for download.

- Best For: Small-to-medium businesses or specific departmental checks where a targeted, ready-made template is needed quickly and without cost.

- Limitation: While the selection is wide, some templates are more foundational than exhaustive. For highly complex, multi-billion dollar transactions, they may serve better as a preliminary guide rather than the sole document, requiring significant customization to meet intricate legal and financial scrutiny.

Practical Tip: Use Lumiform's diverse library to create a "master" folder of checklists for different departments. This allows you to quickly deploy a relevant template whenever a new vendor, property, or small acquisition opportunity arises, standardizing the initial vetting process across the organization.

Access the Templates on Lumiform

11. Smartsheet

Smartsheet transforms the static due diligence checklist into a dynamic, collaborative workspace. Its template is built on a project management platform, making it exceptional for teams that need real-time visibility and task management throughout the diligence process. Rather than a simple spreadsheet, this tool allows for assigning tasks, setting deadlines, and tracking progress in a centralized hub.

This approach is highly effective for complex deals involving multiple departments or external consultants. The platform’s strength lies in its ability to integrate financial assessments, legal compliance checks, and risk analysis into an interactive and accountable workflow. It moves beyond a simple checklist to become a comprehensive project management tool for due diligence.

Key Features & Considerations

- Scope: Covers financial, legal, operational, and general business due diligence categories.

- Format: Interactive Smartsheet template with project management features.

- Best For: Teams that require strong collaboration, task assignment, and real-time progress tracking during due diligence.

- Limitation: While the template is free to download, fully leveraging its collaborative features requires a Smartsheet account. Advanced functionalities like automated workflows and integrations are tied to paid subscription plans, which may be a barrier for smaller teams or one-off projects.

Practical Tip: Use the "Discussions" feature within Smartsheet to keep all communication related to a specific diligence item attached directly to that task. This creates a clear audit trail and prevents critical information from getting lost in email chains.

Access the Template on Smartsheet

12. Monday.com

Monday.com shifts the focus from a static document to a dynamic, collaborative workspace with its Due Diligence Board Template. Instead of a downloadable file, this resource is a pre-built project board within the Monday.com ecosystem. It excels at centralizing tasks, tracking progress visually, and managing team communication, transforming the due diligence checklist template from a simple list into a living project plan.

This approach is perfect for teams that need to manage the diligence process in real-time. The template allows for assigning tasks, setting deadlines, attaching documents, and creating automated notifications. Its visual nature, using status columns and timelines, provides an at-a-glance overview of the entire process, making it easy to spot bottlenecks and keep stakeholders informed.

Key Features & Considerations

- Scope: Focuses on project management of the due diligence process, adaptable to any diligence type (M&A, real estate, vendor).

- Format: Interactive and customizable project board within the Monday.com platform.

- Best For: Teams that prioritize collaboration, real-time tracking, and integrating due diligence into their existing project management workflows.

- Limitation: This is a project management tool, not a pre-populated content checklist. Users must populate the tasks themselves or import them. Access requires a Monday.com subscription, which may be a barrier for teams not already using the platform.

Practical Tip: Use Monday.com's automation features to your advantage. Set up an automation to notify the legal team lead whenever a task in the "Legal Review" group is marked as "Stuck." This ensures critical issues are flagged and addressed immediately without manual follow-up.

Access the Template on Monday.com

Due Diligence Template: Top 12 Tools Comparison

| Solution | Core Features/Characteristics | User Experience & Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ | Price Points 💰 |

|---|---|---|---|---|---|---|

| Demand Metric | 200-item detailed, customizable checklist | Structured, time-saving ★★★★ | Comprehensive diligence | Acquirers & corporate teams 👥 | Extensive checklist, MS Excel format ✨ | Membership required 💰 |

| Ansarada | Legal-focused, data-driven checklist | Data-backed, free access ★★★★ | Proactive legal diligence | All company sizes 👥 | 50M+ data points, automation option ✨ | Free download + platform subscription 💰 |

| SafetyCulture | Editable, mobile-friendly, multi-aspect | User-friendly, mobile-ready ★★★ | Accessible and thorough | General professionals 👥 | Mobile use, PDF format ✨ | Free access 💰 |

| Meegle | Structured, customizable workflow | Intuitive, team-oriented ★★★★ | Free for small teams | M&A, real estate teams up to 20 👥 | Custom workflow, team collaboration ✨ | Free (limit 20 users) 💰 |

| DealRoom | Integrated checklist + virtual data room | Efficient, all-in-one tool ★★★★ | Streamlines document mgmt | M&A professionals 👥 | Virtual data room, Excel import/export ✨ | Subscription + 14-day trial 💰 |

| PaperRock Documents | Tabular, comprehensive legal checklist | Clear, guided, customizable ★★★ | Detailed legal diligence | Business purchasers 👥 | Explanatory guides included ✨ | Paid purchase 💰 |

| Etsy (TerravaTemplates) | 39-category real estate checklist | Editable, user-friendly ★★★ | Affordable real estate focus | Real estate buyers 👥 | Highlighted fields, Word format ✨ | Paid purchase 💰 |

| Superdocu | Curated due diligence templates compilation | Wide selection, descriptive ★★★ | Helps find best-fit templates | Multi-industry users 👥 | Covers free/paid, various industries ✨ | Free access + external sites 💰 |

| Consultport | M&A checklist + report template | Practical, communicative ★★★★ | Facilitates M&A communication | M&A consultants 👥 | Report template, customizable projects ✨ | Free download 💰 |

| Lumiform | 27 free, customizable templates | Easy, multi-industry ★★★★ | Wide accessible options | Broad industry professionals 👥 | Free, multiple scenarios covered ✨ | Free access 💰 |

| Smartsheet | Collaborative checklist with automation | Real-time updates ★★★★ | Team collaboration focus | Teams & corporate users 👥 | Integration & workflow automation ✨ | Free download + acct required 💰 |

| Monday.com | Visual tracking + automation | Highly customizable ★★★★ | Centralized task & communication | Teams & project managers 👥 | Visual boards, automation, integrations ✨ | Subscription-based 💰 |

Choosing the Right Template to Secure Your Success

Navigating the landscape of due diligence can be a formidable task, but as we've explored, you don't have to start from a blank page. The right due diligence checklist template is more than just a list of questions; it's a strategic framework that brings structure, clarity, and efficiency to your most critical business decisions.

Throughout this guide, we've examined a diverse range of tools, from the robust, enterprise-grade platforms of Demand Metric and DealRoom to the highly specialized and accessible templates found on Etsy. We’ve seen how dynamic project management tools like Smartsheet and Monday.com can transform static checklists into collaborative, living documents, while dedicated platforms like Ansarada and SafetyCulture offer deep, industry-specific functionality. The key takeaway is that there is no single "best" template, only the one that best fits your unique situation.

Making Your Selection: A Practical Guide

Choosing the ideal resource requires a clear understanding of your specific needs. Consider the following factors before you commit:

- Scope and Complexity: Is this a multi-million dollar M&A transaction or a smaller-scale vendor assessment? For high-stakes deals, a comprehensive platform like Ansarada or a detailed framework from Consultport is essential. For routine operational checks, a simpler tool like Lumiform or a template from PaperRock Documents might be more than sufficient.

- Collaboration Needs: How many people are involved in the process? If your team is large and cross-functional, a collaborative platform like Monday.com or Smartsheet is invaluable. These tools centralize communication, track progress in real-time, and ensure everyone is working from the same playbook.

- Budget and Resources: Your budget will naturally guide your decision. While premium platforms offer powerful integrated features, cost-effective options from Etsy or free templates from sources like Superdocu provide excellent starting points that can be customized to fit your needs without significant financial investment.

- Customization vs. Specialization: Do you need a highly specialized legal due diligence checklist, or a broader, more general business template that you can adapt? Don't be afraid to mix and match. You can leverage a specialized legal checklist from one source and integrate it into a broader project management template from another.

Implementing Your Checklist for Maximum Impact

Once you’ve selected a template, implementation is your next critical step. Remember that even the most detailed due diligence checklist template is just a starting point. Tailor it to the specifics of your deal or project, removing irrelevant items and adding questions that address your unique risks and opportunities. To further inform your decision on the ideal template, explore a comprehensive guide on the Top Due diligence Checklist for 2025 Success, offering insights into key evaluation areas.

Ultimately, your goal is to move beyond mere box-ticking. Use your chosen checklist to foster critical thinking, drive meaningful discussions, and uncover the insights that lead to confident, well-informed decisions. This structured approach not only mitigates risk but also illuminates opportunities, paving the way for successful outcomes and long-term value creation.

After completing your due diligence, the next step is often integrating new systems and ensuring operational excellence. For businesses dealing with complex electronic systems and data management, Electronic Finishing Solutions provides the critical tools to streamline post-acquisition integration and optimize performance. Discover how their advanced solutions can help you manage and finalize your digital infrastructure with precision at Electronic Finishing Solutions.